Individual to organisation.Basic strategy to advanced.Spectra helps you connect the dots.

For TradersExplore a new interest rates market and get exposure to yield volatility.

For Risk HedgersHedge your exposure to yield volatility with Spectra's fixed rates.

For OrganisationsDiscover new incomes strategies, manage your cashflow efficiently with a suite of products.

For Liquidity ProvidersGet extra interest on top of your yield generating positions.

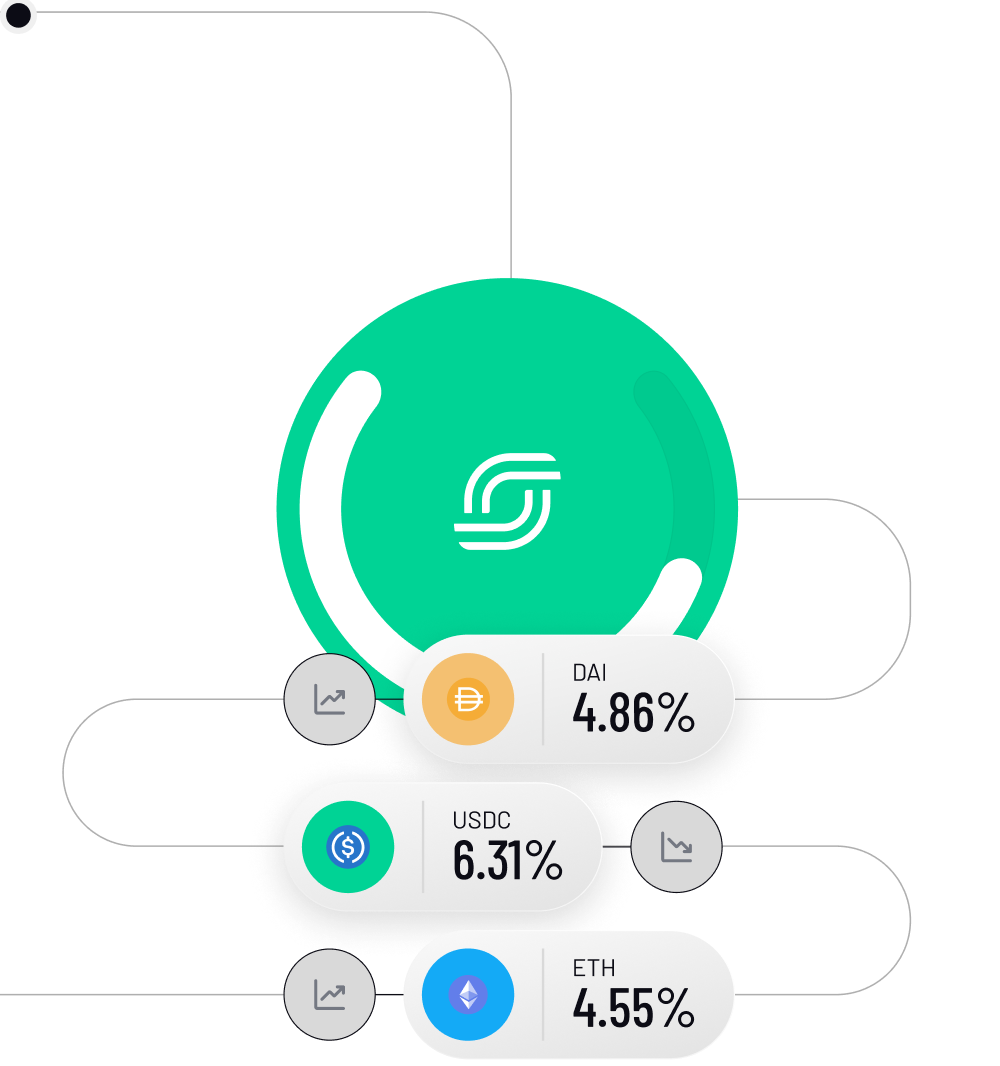

Fix Interest Rates

No more rate volatility. With Spectra, you can lock in a fixed rate on your yield strategy in a few clicks and earn fixed return.

Spectra Ecosystem